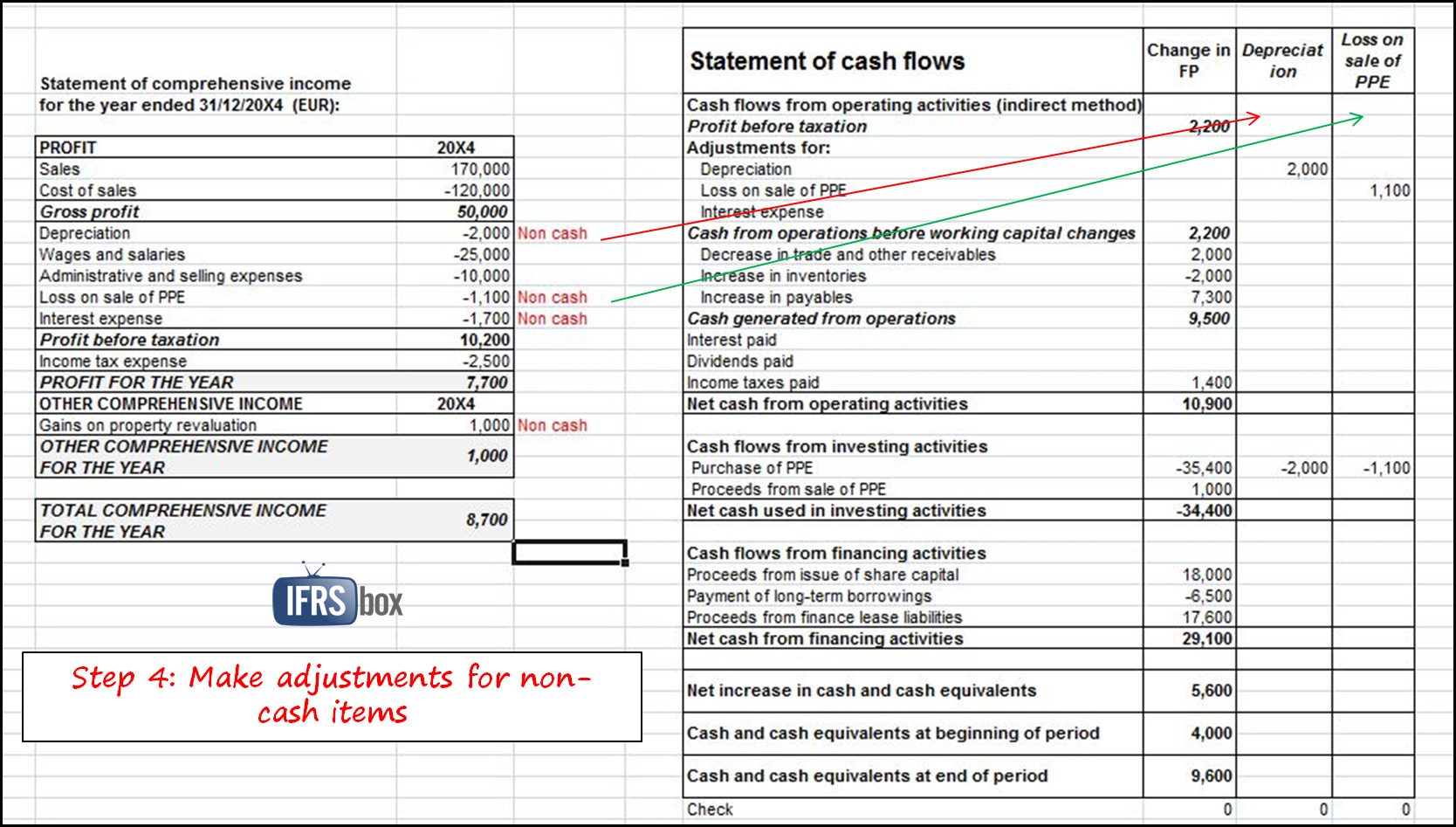

Noncurrent liabilities and owners’ equity balances found on the balance sheet, coupled with other information (e.g., cash dividends paid) are used to perform this step.Įach section of the statement of cash flows described in steps 1, 2, and 3, will show the total cash provided by (increase) or used by (decrease) the activity. This step focuses on the effect changes in noncurrent liabilities and owners’ equity have on cash. Prepare the financing activities section by presenting cash activity for noncurrent liabilities and owners’ equity. Noncurrent asset balances found on the balance sheet, coupled with other information (e.g., cash proceeds from sale of equipment) are used to perform this step. This step focuses on the effect changes in noncurrent assets have on cash. Prepare the investing activities section by presenting cash activity for noncurrent assets. It tells the reader how much cash was received from the daily operations of the business. Cash provided by operating activities represents net income on a cash basis. begins with net income from the income statement and makes several adjustments related to changes in current assets, current liabilities, and other items to arrive at cash provided by operating activities (or used by operating activities if the result is a cash outflow). The indirect method A statement of cash flows method that begins with net income from the income statement and makes several adjustments related to changes in current assets, current liabilities, and other items to arrive at cash provided by (used by) operating activities. The appendix describes the direct method. Because more than 98 percent of companies surveyed use the indirect method (see Note 12.15 "Business in Action 12.3"), we will use the indirect method throughout this chapter. This step can be done using one of two methods-the direct method or the indirect method. Prepare the operating activities section by converting net income from an accrual basis to a cash basis. What are these four steps?Īnswer: The four steps required to prepare the statement of cash flows are described as follows: Question: With this information in hand, four steps are required to prepare the statement of cash flows. Other information is needed to complete the statement of cash flows, such as cash dividends paid and the original cost of long-term investments sold.Income statement information for the current year is needed as the starting point for converting net income from an accrual basis to a cash basis, which is shown in the operating activities section of the statement of cash flows.

These changes in balance sheet accounts are needed to prepare certain parts of the statement of cash flows.

However, the statement of cash flows is based on cash flows only, and thus adjustments must be made to convert accrual basis information to a cash basis. The income statement, balance sheet, and statement of owners’ equity are all created using the accrual basis of accounting. Conversely, the cash basis of accounting recognizes revenue when cash is received and expenses when cash is paid, regardless of when goods or services are exchanged. Question: Recall from your financial accounting course that the accrual basis of accounting recognizes revenue when earned and expenses when incurred, regardless of when cash is exchanged. Describe the four steps used to prepare the statement of cash flows.

0 kommentar(er)

0 kommentar(er)